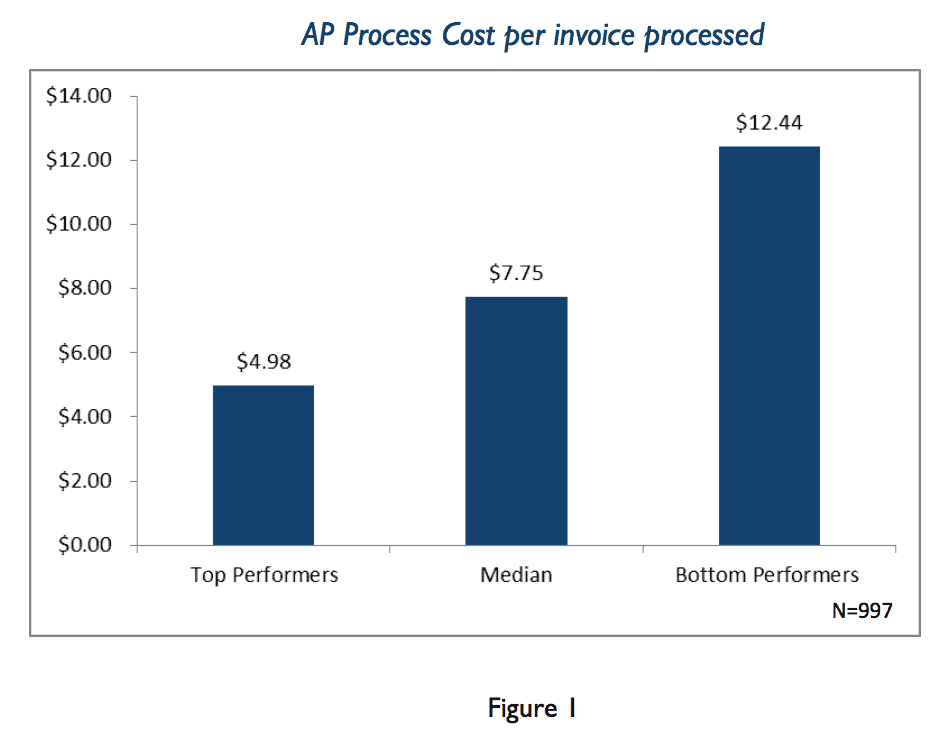

Experts on corporate payment systems underscore the virtues of electronic invoice presentment, processing, and payment (EIPP) technologies. Such investments, they argue, can significantly lower the cost of processing invoices for payment. A review of APQC’s Open Standards Research on accounts payable (AP) process costs certainly demonstrates that there is a significant improvement opportunity for organizations that have yet to optimize in this area. The metric of special interest here is “AP Process Cost per Invoice Processed.” See Figure 1. The laggards spend two and one-half times more than the top performers spend per invoice.

In this analysis, 997 organizations were isolated. The calculation for this metric isolates the annual AP process cost divided by the total number of invoices processed annually. The process cost includes personnel (compensation and benefits), systems, overhead, outsourcing (to either a company-owned shared services center or to a third-party), and miscellaneous.

What drives up the cost? The need for manual intervention. Labor costs typically consume 62% of total AP costs, according to the APQC research. And what necessitates manual intervention? Data errors in purchase orders (POs), shipping or receiving documents, and invoices require humans to step in. Such errors prevent the buyers’ transaction processing system from performing automatic data matches that are necessary for the system to designate automatically that a payable is “OK to be scheduled for payment.” Beyond that, poorly designed billing systems on the supplier side can cause process bottlenecks in the customer’s AP function.

In all, EIPP technology streamlines communication and data processing and reduces the need for manual intervention. By automating payment timing, they also help organizations capture more pre-negotiated early payment discounts. Added up over the course of a year, the savings can be dramatic. Obviously, not every company has the leverage to dictate to their suppliers that they must send digitized –or digitize-able—invoice data. But many companies committed to running as lean as possible, in every aspect of their business, are realizing that investment in automation will, all things being equal, quickly pay for itself.

This AP process metric suggests that AP managers ought to consider ways in which they can turn paperbased invoices (sent by suppliers) into digitized files that the their financial systems can read, process, and schedule for payment – all without manual intervention. Options for change range from very basic on-premises scanning to advanced, cloud-based electronic data capture operated by a third-party service provider. Whatever the solution looks like, the simple truth for most CFOs is that the cost of dealing with paper invoices is a burden that no longer can be justified.

Drowning in Paper

Finance leaders have been looking at AP automation for some time. It’s safe to assume that large organizations with sound strategies for leveraging their investments in enterprise-resource-planning (ERP) technology are likely to have deployed advanced solutions by now. Turning paper-based invoices into machine-readable data streams is a common application.

It’s also safe to assume these large outfits have been increasing labor productivity in the process: doing more without increasing headcount (or reducing headcount outright).

What do we mean by top versus bottom performers? The organizations that are called top performers in this instance are those that manage a volume level per individual FTE that is larger than that handled by FTEs at 75 percent of the other organizations in this data set.

In summary, as any business major will attest, achieving high levels of labor productivity compared to sector peers is a tried-and-true way to control the operating costs. That’s the “trickle up” effect. As mentioned earlier, there are many ways to automate, some requiring more effort and expense than others. Moreover, adopting a shared services model and deploying AP automation in that environment is a reliable strategy for wrangling AP costs. That could come in especially handy when the growth strategy of the business calls for a string of acquisitions—and the acquirer’s shared services center needs to absorb the AP processing activity of the newly acquired company. So, it’s not entirely about bringing functional costs down just to look good in front of the top brass. It’s about your business needs, now and in the future. To learn how cost-effective it will be to transition to AP Automation, call us today at 1-800-719-9621 or contact us by clicking the ‘Contact’ button below.

ABOUT APQC

APQC is a member-based nonprofit and one of the leading proponents of benchmarking and best practice business research. Working with more than 500 organizations worldwide in all industries, APQC focuses on providing organizations with the information they need to work smarter, faster, and with confidence. Every day we uncover the processes and practices that push organizations from good to great. Visit us at www.apqc.org and learn how you can make best practices your practices.

©2015 APQC. ALL RIGHTS RESERVED